They’re not even subtle about it. The system directly rewards you for being in enough debt to always be paying someone interest but not enough that you might file for bankruptcy.

You don’t have to be in debt, but you do need open credit lines. Having debt on them actually makes your score worse.

Her score likely went down because she closed out a credit line, i.e the open loan, so technically the “i have an open 5yr loan ive been paying on diligently” is no longer part of her score. The fact that she did pay it off is part of that score, but its weighted differently.

If she instead had 40k of credit cards she had open for 5yrs, with zero debt on them, her score would have gone up. Just having the account open, even not using them, shows a high “credit to debt usage” ratio and “a long time open loan.” Both of those make up about 45% of your “credit score.”

So no, you dont have to use a CC every month to keep a high credit score. If you want a high score, you want to open a credit card or 2 for their max value until you get about 30k-40k of total credit, and then don’t use them at all. Not a bit. Never close them. The “long time accounts” + “high amount of debt not in use” + “never delinquent” is roughly 80% of your score. You can sail into the 700s/800s if you dont have any other credit hit.

While this is all technically correct it’s still dogshit that your score goes down when you do the thing you are supposed to do with a loan.

Your options are:

Take out a loan and pay it off: score goes down

Take out a loan and don’t pay it off/default: score goes down

I paid a credit card down from $1700 to $1200. My score went from 795 to 763. Fuck 'em and their fake money.

You’re still carrying a balance of $1200 though. Pay it off and it should go up.

They like their little debt slaves

Can someone explain why the credit score is so important for americans? Are most of them getting loans for things to live?

Most Americans can’t afford a $400 emergency and live pay check to paycheck. Car breaks down, emergency medical expenses, emergency house breaks down could all cost over $400. You need a Credit card for that back up that you could eventually pay back by probably sacrificing something else. Need a car need a credit score or you pay $3-10,000 more in interest same with buying a home. Want to rent need a credit check. Want to get a job at a bank, military contractor, some government positions, and other secure jobs. They want to make sure you don’t have bad credit or can’t be taken advantage of . Which no credit is often considered bad credit.

Yes, you are incentivized to stay in debt, because creditors want to know that you are both willing to take on debt AND pay it off. The sweet spot for them is someone who never really pays it off but still makes minimum payments while interest piles on. This is the system working as intended.

ITT I’m seeing a few common misconceptions repeated by many otherwise correct and knowledgeable commenters without remediation. I’m addressing them here, because understanding financial systems empowers everyone, whether they wish to use them, change them, or burn them to the ground.

- Lenders only see your credit score. Mixed truth. Lenders can order specific scores to get a quick idea of credit-worthiness, but for most credit decisions a credit report or ordered. (This is often called a hard inquiry, and indicates a credit was applied for. A single inquiry is basically ignored by most scoring models. Many inquiries in a short timespan can be considered risky.) Regardless, the report is the same one you see when you order it directly from a credit bureau.

- Your credit score is universal. Mostly false. Credit scores are just someone’s guess of your risk to a lender based on data reported by previous lenders. Good guessers can make money guessing, but none are perfect, and some are only good at guessing risk for specific contexts. Who are they? First, there are the bureaus. They have various branded scores that they sell as products to lenders (for credit decisions) and borrowers (for credit building). Next, there are numerous companies who exclusively develop and sell scoring models. Finally, some lenders such as larger banks develop their own internal scoring models. All the above are adjusted regularly and tailored for specific industries and debt classes. I say “mostly false,” because it’s true that many scores use similar scales and the same records, which means they tend to rise and fall together. That’s why lot of people, even financial wellness advocates, often talk about “your score” as if it’s a single agreed-upon value, but the reality is scores are numerous, distinct, and variable.

- Credit reporting agencies use personal information for scoring. Mixed truth. Many bureaus have affiliated entities that broker financial data for ad revenue, but the information they are allowed to distribute in credit reports is tightly regulated in most countries. (Exceptions: there are alternative scoring model providers who fill a gap of niche debt types sought by applicants with no credit history, such as LexisNexis’ “RiskView” which can use more personal details like address stability and online purchase history to determine risk.)

- Credit history is permanent. False. Negative records like late payment, non-payment, and bankruptcies have expiration dates by law in most countries. Aside from when accounts were opened and closed, generally nothing in a credit report is permanent, and the scores can be extremely variable in practice.

- I should worry about my old credit score. False. Credit scores are used and discarded. New score overwrites old. The only thing that persists would be a credit decision, if there is one. Most scores are partially based on transient data and thus can bounce around wildly. For example, VantageScore 2.0 can dip by over 150 points because a large transaction put a card slightly over the limit but then rebound 150 points after the balance is reported within the limit. Similarly, FICO 8 can jump by 100 points just because the applicant was added as an authorized user to a card with a long payment history. Likewise, most scores can rise and fall drastically based on credit utilization (which is usually reported based previous statement balance, meaning even if you pay off cards every month your credit score will fluctuate in proportion to variance in monthly spending).

- Banks like credit card debt. False True. (Corrected by @d00ery@lemmy.world) Banks love it when you carry a balance. The interest accounts for the majority of their revenue.

The volatility of scoring is the most important takeaway, I think. The temporary nature of scores can be exploited pretty easily. If you understand how they work, you can often get the score you need at a particular time with a bit of planning. And the rest of the time, when you aren’t using your scores for anything, they’re vanity numbers at best.

Anyway, if I missed something or am wrong, please point it out.

I was under the impression that many hard inquiries in a small time frame was ignored because it means you’re shopping for a loan.

Having a single hard enquiry every so often would mean you’re needing to keep borrowing money for some reason.

True. This inquiry collapsing behavior is a feature of recent iterations of two popular models: FICO (8,9,10) and VantageScore (2.0,3.0).

Note however that:

- It only works for certain types of debt. For example, FICO8+ includes auto, student, and mortgage. VantageScore2+ includes utilities, auto, mortgage. No model includes revolving accounts like credit, retail, or charge cards.

- The inquiry collapsing behavior only occurs within a single asset class. For example, FICO8+ would collapse simultaneous shopping for student loans, car loans, and mortgages into 3 inquiries, not 1.

- The shopping period varies. FICO8+ ignores same-class inquiries for 30 days and collapses same-class inquiries within a 45-day window. VantageScore2+ does the same but only within a 14-day window.

Bonus hack: Certain banks also routinely collapse/reuse inquiries for same-day applications, permitting additional applications “for free,” which can be useful if you are denied your first choice and have a fallback in mind or if you are instantly approved for one product and want to try for another.

Credit rating measures your profitability to the credit industry, if you pay off your loan early, they make in interest, thus less profit.

Not entirely true. I’m what they call a deadbeat (meaning I pay off my cards in full every month and have been doing so for the past 10 years, making them $0 profit), and I have a 800 score.

I think the more correct way to think about it is that it’s an estimate of your profit potential. What everyone tells you to do with a score this high is to buy a house because you qualify for the best mortgage interest rates. But of course then they’ll have me on the hook for the next 30 years, and they stand to make in excess of $100k in profit.

100K profit on a mortgage? that’s insane

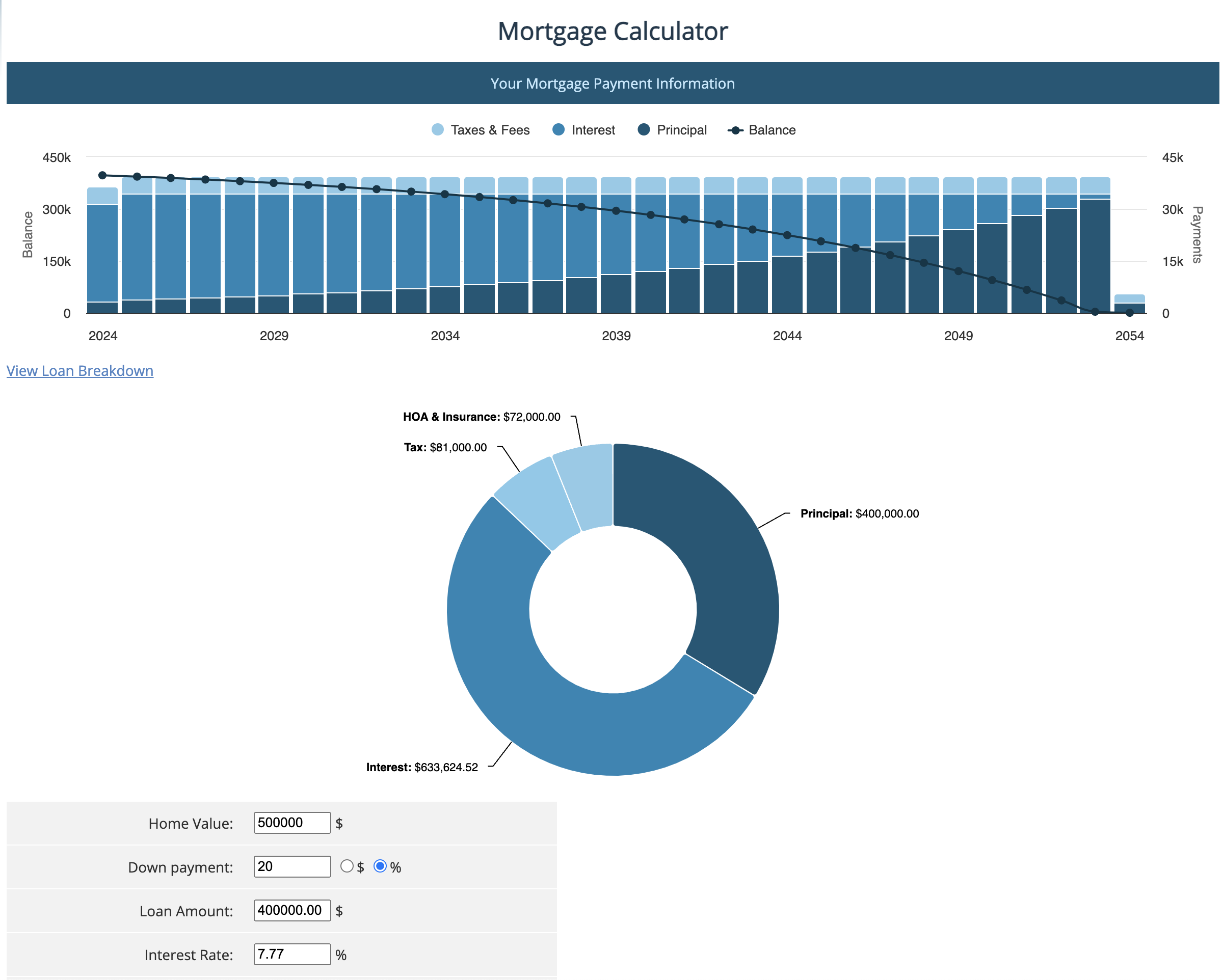

It’s actually far worse than that. If you get $400k loan at the current rate and pay it off over 30 years, you’ll end up paying over 1.5x times the principal in interest. Over the lifetime of the loan, a $500k home will cost you over $1M.

(from mortgagecalculator.org)

Wait why are the banks investing in home loans when instead investing that money into the stock market (should?) yield greater returns over the course of the loan period (even at a very conservative 5% yearly compounding interest, $400,000 turns into $1.7M over the course of 30 years)

Mortgages are fixed income. Stock market returns are variable and therefore riskier. One bad year can wipe out multiple years of gains. Meanwhile, the money you collect as interest has already been paid, and as you can see from the calculator, the interest is front loaded, meaning the majority of it is paid at the beginning of the loan. So even with the probability of a default wiping out the remainder that’s owed, it’s still a much safer investment.

Why aren’t these practices considered criminal?

What is your proposed alternative system? All of this is just an interest rate applied to an outstanding balance. Many less people would own a house without such an option.